Business Families

Business Families

A problem solved

In 1999, three family business owners asked me to advise them independently in the management of their financial assets.

I understood that this need could not be addressed through the traditional private banking. The right solution was a multi-family office dedicated to the business family.

I decided to undertake that challenge. Anchor Capital Advisors is the outcome.

Family team

Each person has their needs, goals, expectations, strengths, and fears. By articulating a joint family strategy, together they create value that transcends to the next generation.

We know the challenges a business family confronts. Our experience sustains the fact that an independent advisor brings objectivity to the family council. This objectivity is the key to:

- Rigorous decision-making that improves the family group.

- Ensure that the different needs of all members are addressed.

- Secure the family legacy.

Our Role

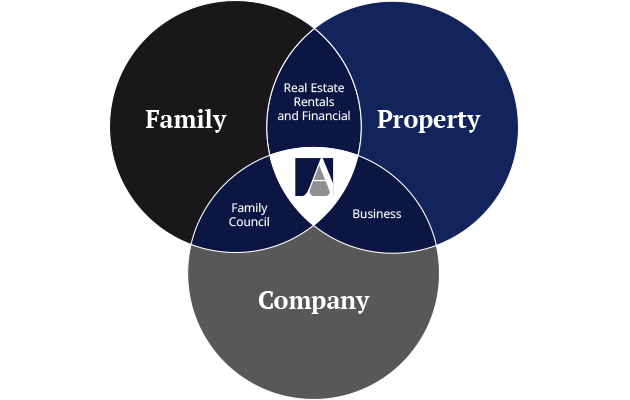

Family

- We join the Family Investment Committee to define the Strategy and financial-tax planning of the family group at all levels.

- We are an independent advisor: we represent the interests of the family and not those of banks or other asset managers.

- We are a mentor to coach members of the family group, to ensure that the family heritage transcends for many generations.

- We manage the investments of each member of the family because each generation has different needs and goals.

Company

- We optimize the capital structure of the family business.

- We provide consulting on business strategy.

- We value mergers and acquisitions processes related to the company.

- We advise on how to invest the financial surpluses of the company.

Estate

- Real estate strategy of the properties of the family group.

- Planning and reinvestment of real estate income.

- Financing optimization in the acquisition of real estate.

Besides...

We work with fully trusted partners, which gives us all the flexibility to provide solutions to any specific issue of the business family.