Family Office

Family Office

As a multi-Family Office, we know the challenges working for a business family mean. We provide professional support to the Family Office so that it can navigate the markets and always reach a good port: we are the crew that any seasoned Captain needs.

What do we offer?

Our solutions help to empower the selection and analysis of assets, investment strategies, control, and risk management in the Family Office. Our value proposition for the Family Office is based on 4 pillars that will exponentially increase your executive capacity:

Analysis for decision-making

We generate quantitative reports of funds, stocks, and bonds to improve the decision making with statistical data:

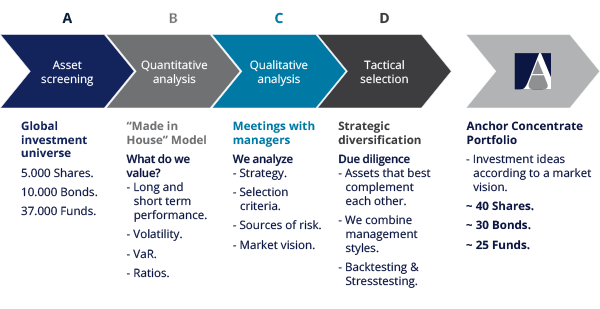

Independent selection of assets

We select, with our own screening methods, the assets that best fit our market vision. This will allow the Family Office to take an active role with other financial entities, such as banks and asset management companies:

Holistic vision of markets

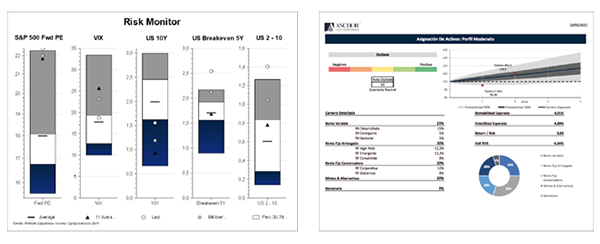

As independent advisers, we offer a complete and unbiased view of the financial markets, effectively identifying risks and opportunities:

- Proprietary 360-degree factor-based model to position investments according to a comprehensive strategic vision.

- Second opinion, with independent criteria, on assets and portfolios of the family group, with specific and periodic analysis.

- Market reports and risk monitors, which will make it possible to underpin the investment strategy of the Family Office during the investment committees and family councils.

- Support in the asset allocation process to define discretionary management mandates and their external control.

Online Reporting

We work with top-class partners who enable us to offer a wide range of technological solutions for the daily management of investment portfolios:

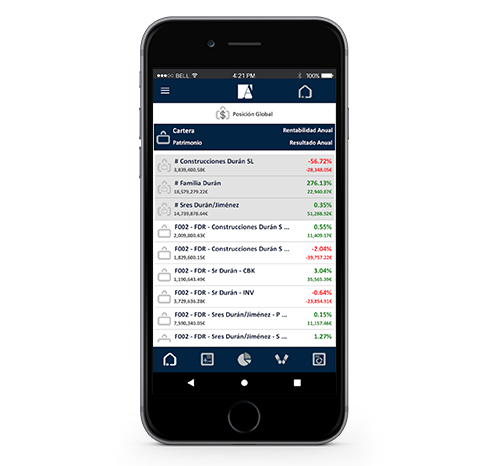

- Reports with different levels of consolidation, both for the Family Office and for each family and individual members, with personalized accesses.

- Availability to access portfolios and reports on Anchor 24/7, both via Web and our free app on iOS and Android.

- Risk management: volatility control to limit losses, avoid surprises and reduce or increase exposure when appropriate.